LOAN PRODUCTS

Choose your state of residence to learn about your loan options

LOAN OPTIONS IN UTAH

LOAN AMOUNT RANGES: $250 - $1,000

LOAN TERM: 6 - 20 Months

For personal loans in Utah, KwikCash is the preferred provider, known for its customer-centric practices and accessible lending solutions. With a focus on transparency and simplicity, KwikCash offers straightforward application processes and flexible repayment terms customized to individual preferences. Moreover, our dedication to responsible lending ensures that individuals with less-than-perfect credit histories can still access financing, supported by guidance to improve their financial health. By selecting KwikCash, consumers in Utah can confidently access necessary funds, backed by a reputable lender committed to their financial well-being.

KwikCash makes a wide spectrum of loan products available to accommodate customers with a range of credit scores. Loan amounts start $250 for those residing in Utah. Published rates are subject to change without prior notice and not all applicants will qualify. Underwriting guidelines and other terms and conditions apply to all loan applications.

The Utah Consumer Credit Code, Title 70C of the Utah Code (“UCCC”), governs consumer credit transactions in Utah. Although certain internal references have historically cited “Section 70C of the Utah Code,” such references were intended to identify Title 70C, which comprises the Utah Consumer Credit Code in its entirety.

Pursuant to Utah Code Ann. § 70C-1-201, the UCCC applies to credit extended by a creditor to an individual for personal, family, or household purposes unless specifically exempted under § 70C-1-202.

KwikCash offers unsecured, consumer-purpose installment loans ranging from $250 to $1,000. These loans do not fall within any categorical exemption under § 70C-1-202. Accordingly, such loans are subject to the UCCC, and required disclosures are provided in compliance with applicable provisions of the Code.

LOAN OPTIONS IN ALABAMA

LOAN AMOUNT RANGES: $2,000

LOAN TERM: 10 - 24 Months

KwikCash emerges as the top pick for personal loans in Alabama, thanks to its dedication to customer-centric approaches and easily accessible lending solutions. Prioritizing transparency and ease, KwikCash provides simple application procedures and customizable repayment plans designed to suit each borrower’s requirements. Furthermore, our commitment to responsible lending assures individuals with imperfect credit records the chance to obtain funding, coupled with assistance and direction to enhance their financial stability. Opting for KwikCash allows Alabama consumers to obtain necessary funds with assurance, aligning with a trustworthy lender committed to their financial prosperity.

LOAN OPTIONS IN MISSISSIPPI

LOAN AMOUNT RANGES: $501 - $1,000

LOAN TERM: 7 - 11 Months

For personal loans in Mississippi, KwikCash stands out as the preferred choice, distinguished by its commitment to customer-centric principles and accessible borrowing options. Prioritizing transparency and simplicity, KwikCash streamlines the application process and offers flexible repayment terms customized to meet individual needs. Furthermore, our unwavering dedication to responsible lending means that individuals with less-than-perfect credit can still access financing, supported by guidance to enhance their financial stability. By opting for KwikCash, consumers in Mississippi can secure the funds they need with confidence, backed by a reputable lender dedicated to their financial welfare.

Compliance with Mississippi Regulations

We operate in compliance with Mississippi regulations, License No. 003359.

Governing Law

If you have questions or concerns about your loan, please contact KwikCash by phone at 800-478-6230 or by sending an email to info@kwikcashonline.com.

If KwikCash is unable to address your questions or concerns, you can also contact the state regulatory agency directly:

Department of Banking and Consumer Finance

P.O. BOX 12129 | JACKSON, MS 39236-2129

TEL.601.321.6901 | FAX.601.321.6933

http://www.dbcf.ms.gov/

LOAN OPTIONS IN SOUTH CAROLINA

LOAN AMOUNT RANGES: $601 - $1,000

LOAN TERM: 6 - 20 Months

In South Carolina, KwikCash is the preferred provider for personal loans, known for its dedication to customer-centric principles and accessible lending solutions. Emphasizing transparency and simplicity, KwikCash offers straightforward application processes and adaptable repayment terms designed to fit individual circumstances. Additionally, our commitment to responsible lending means that even individuals with less-than-perfect credit histories can secure financing, complemented by assistance to enhance their financial stability. By choosing KwikCash, consumers in South Carolina can access essential funds with confidence, assured of partnering with a reputable lender focused on their financial prosperity.

LOAN OPTIONS IN MISSOURI

LOAN AMOUNT RANGES: $250 - $1,000

LOAN TERM: 6 - 20 Months

LOAN RATE: 99% - 499%

KwikCash is the top choice for personal loans in Missouri, thanks to its customer-centric practices and convenient lending options. With a focus on transparency and ease, KwikCash offers simple application processes and flexible repayment terms tailored to each borrower’s needs. Moreover, our commitment to responsible lending ensures that individuals with imperfect credit histories can access financing while receiving support to improve their financial health. By selecting KwikCash, consumers in Missouri can confidently access the funds they need, knowing they’re partnering with a reputable lender devoted to their financial well-being.

Compliance with Missouri Regulations

We operate in compliance with regulations via our lending license below

LOAN OPTIONS IN IDAHO

LOAN AMOUNT RANGES: $250 - $1,000

LOAN TERM: 6 - 20 Months

In Idaho, KwikCash shines as the go-to option for personal loans, renowned for its customer-focused practices and convenient lending solutions. With a core emphasis on transparency and user-friendliness, KwikCash offers straightforward application processes and adaptable repayment terms tailored to individual preferences. Additionally, our steadfast commitment to responsible lending ensures that even individuals with less-than-perfect credit histories can secure financing, coupled with guidance to bolster their financial well-being. By selecting KwikCash, consumers in Idaho can access essential funds confidently, knowing they’re partnering with a reputable lender dedicated to their financial success.

LOAN OPTIONS IN WISCONSIN

LOAN AMOUNT RANGES: $250 - $1,000

LOAN TERM: 6 - 20 Months

KwikCash is the standout choice for personal loans in Wisconsin, distinguished by its commitment to customer-centric practices and easily accessible lending options. Prioritizing transparency and simplicity, KwikCash provides straightforward application processes and flexible repayment terms tailored to individual needs. Additionally, our dedication to responsible lending ensures that borrowers with less-than-perfect credit histories can secure financing, accompanied by support and guidance to enhance their financial stability. By choosing KwikCash, consumers in Wisconsin can access essential funds with confidence, assured of partnering with a reputable lender focused on their financial prosperity.

LOAN OPTIONS IN CALIFORNIA

LOAN AMOUNT: $10,000 - $20,000

LOAN TERM: 60 Months

KwikCash stands out as a preferred choice for personal loans in California due to its commitment to customer-centric practices and accessible lending options. With a focus on transparency and simplicity, KwikCash offers straightforward application processes and flexible repayment terms tailored to individual needs. Moreover, our dedication to responsible lending practices ensures that borrowers with less-than-perfect credit histories have opportunities to secure financing while also receiving support and guidance to improve their financial health. By choosing KwikCash, consumers in California can access the funds they need with confidence, knowing they’re partnering with a reputable lender dedicated to their financial well-being.

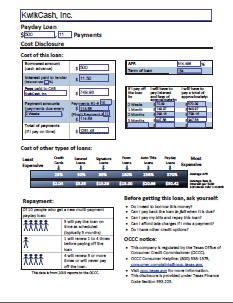

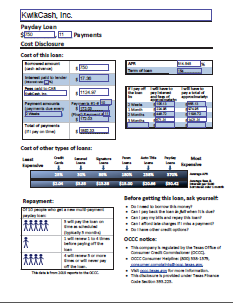

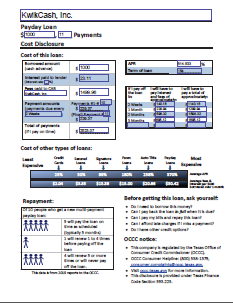

LOAN OPTIONS IN TEXAS

LOAN AMOUNT RANGES: $250 - $1,000

LOAN TERM: 5 Months

In Texas, KwikCash is not a lender. KwikCash acts as a Credit Services Organization (CSO) and Credit Access Business (CAB) and will attempt to arrange a loan between you and an unaffiliated third party lender ("Lender").

KwikCash sets itself apart as the leading choice for personal loans in Texas, distinguished by its customer-centric practices and convenient lending options. With a focus on transparency and simplicity, KwikCash offers straightforward application procedures and flexible repayment terms tailored to individual needs. Furthermore, our commitment to responsible lending ensures that borrowers with imperfect credit histories have opportunities to secure financing, coupled with guidance to improve their financial well-being. By opting for KwikCash, consumers in Texas can access the funds they need with confidence, knowing they’re partnering with a reputable lender dedicated to their financial success.

Sample Schedule of All Fees

| Most Common Loan Amount Borrowed |

CSO FEE | LENDER INTEREST (9.90% PER YEAR) |

TOTAL FEES/INTEREST |

TOTAL OF PAYMENTS |

APR | Common Loan Term |

| $500 | $749.98 | $11.50 | $761.48 | $1,261.48 | 514.50% | 154 Days (11 Bi-Weekly Payments) |

| $750 | $1,124.97 | $17.25 | $1,142.22 | $1,892.22 | 514.50% | 154 Days (11 Bi-Weekly Payments) |

| $1000 | $1,499.96 | $23.00 | $1,522.96 | $2,522.96 | 514.51% | 154 Days (11 Bi-Weekly Payments) |

Sample Loan Terms

Below are 3 typical examples of multi-payment loans that kwikcashonline.com can help arrange for you. Please click on the link that is closest to the loan amount you are seeking.

|

|

|

| $500 Loan | $750 Loan | $1000 Loan |

If you have questions or concerns about your loan, please contact KwikCash by phone at 800-478-6230 or by sending an email to info@kwikcashonline.com. If KwikCashOnline.com is unable to address your questions or concerns, you can also contact the Office of Consumer Credit Commissioner.

OCCC Consumer Credit Notice

This business is licensed and examined under Texas law by the Office of Consumer Credit Commissioner (OCCC), a state agency. If a complaint or question cannot be resolved by contacting the business, consumers can contact the OCCC to file a complaint or ask a general credit-related question. OCCC address: 2601 N. Lamar Blvd., Austin, Texas 78705. Phone: (800) 538-1579. Fax: (512) 936-7610. Website: occc.texas.gov. Email: consumer.complaints@occc.texas.gov.

Office of Consumer Credit Commissioner

2601 North Lamar Blvd

Austin, TX 78705-4207

Phone: 512-936-7600 or toll free 1-800-538-1579

Email: consumer.complaints@occc.state.tx.us

http://occc.state.tx.us

An advance of money obtained through a payday loan or auto title loan is not intended to meet long-term financial needs. A payday loan or auto title loan should only be used to meet immediate short-term cash needs. Refinancing the loan rather than paying the debt in full when due will require the payment of additional charges.

Compliance with Texas Regulations

We operate in compliance with Texas regulations via our CAB License and CSO Registration below:

You are in charge of how much interest you pay

Pay your loan back as soon as you can for the best savings

No pre-payment penalty fees on early payoffs

KwikCash makes a wide spectrum of loan products available to accommodate customers with a range of credit scores. The lowest rates and higher loan amounts are reserved for customers with excellent credit. Actual rates vary by applicant depending on state of residence, your supporting documentation, and underwriting. Published rates are subject to change without prior notice and not all applicants will qualify. Underwriting guidelines and other terms and conditions apply to all loan applications.

Kwikcash Inc. is an installment lender offering loans to residents in those states where permitted by law. The content of Kwikcashonline.com does not signify a solicitation or offer for loans in all areas. Areas of operation may change with or without notice. Services mentioned on this website may or may not be available in your particular area.